Perfect Info About Which Chart Pattern Has The Highest Accuracy Change Markers In Excel

Published aug 4, 2022.

Which chart pattern has the highest accuracy. They provide technical traders with. Do stock chart patterns work? The price reached the expected level.

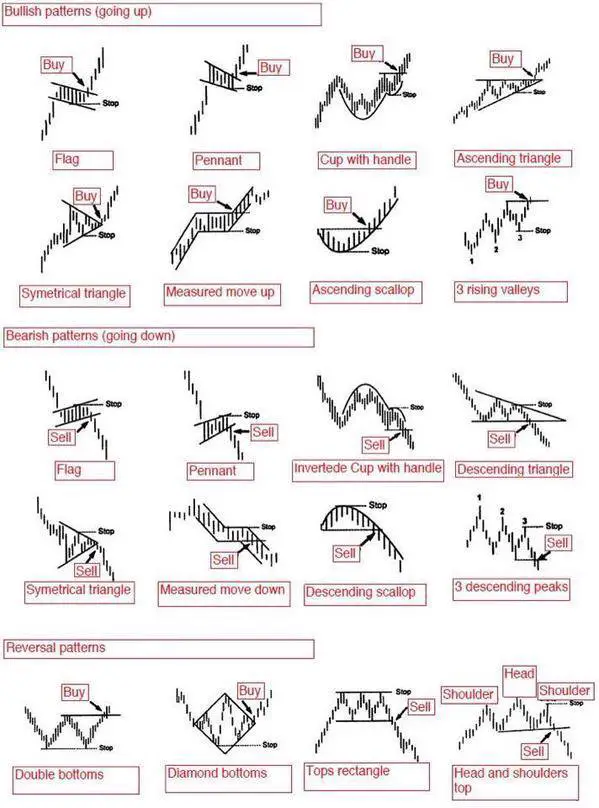

So what are chart patterns? There are 4 statuses in total: The price did not reach the expected level and did not go above the last top.

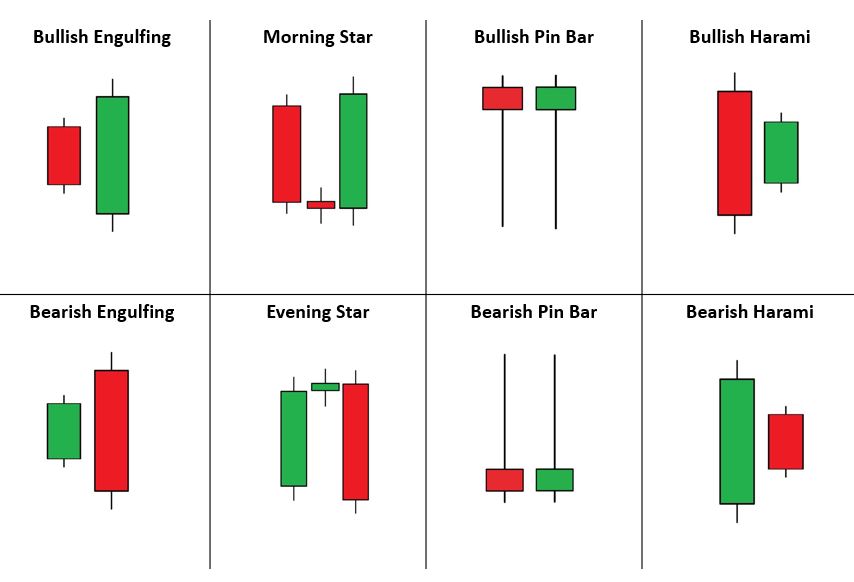

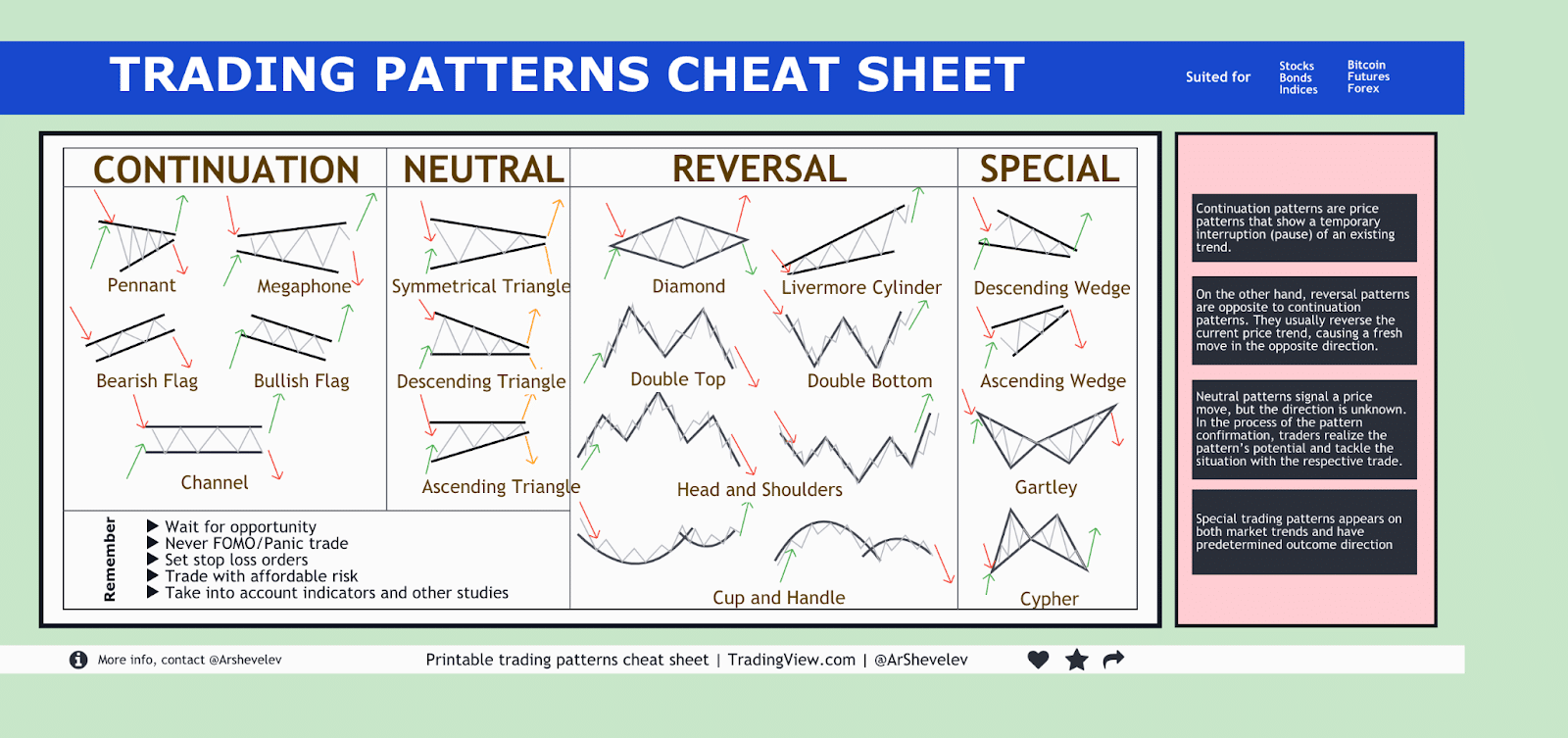

Unlike a line chart or a bar chart, a japanese candlestick. As the name suggests, single candlestick patterns are chart formations made of just one candlestick. The following guide will examine chart patterns, what they are, the different types, and how to use them as part of your trading strategy, as well as present you with.

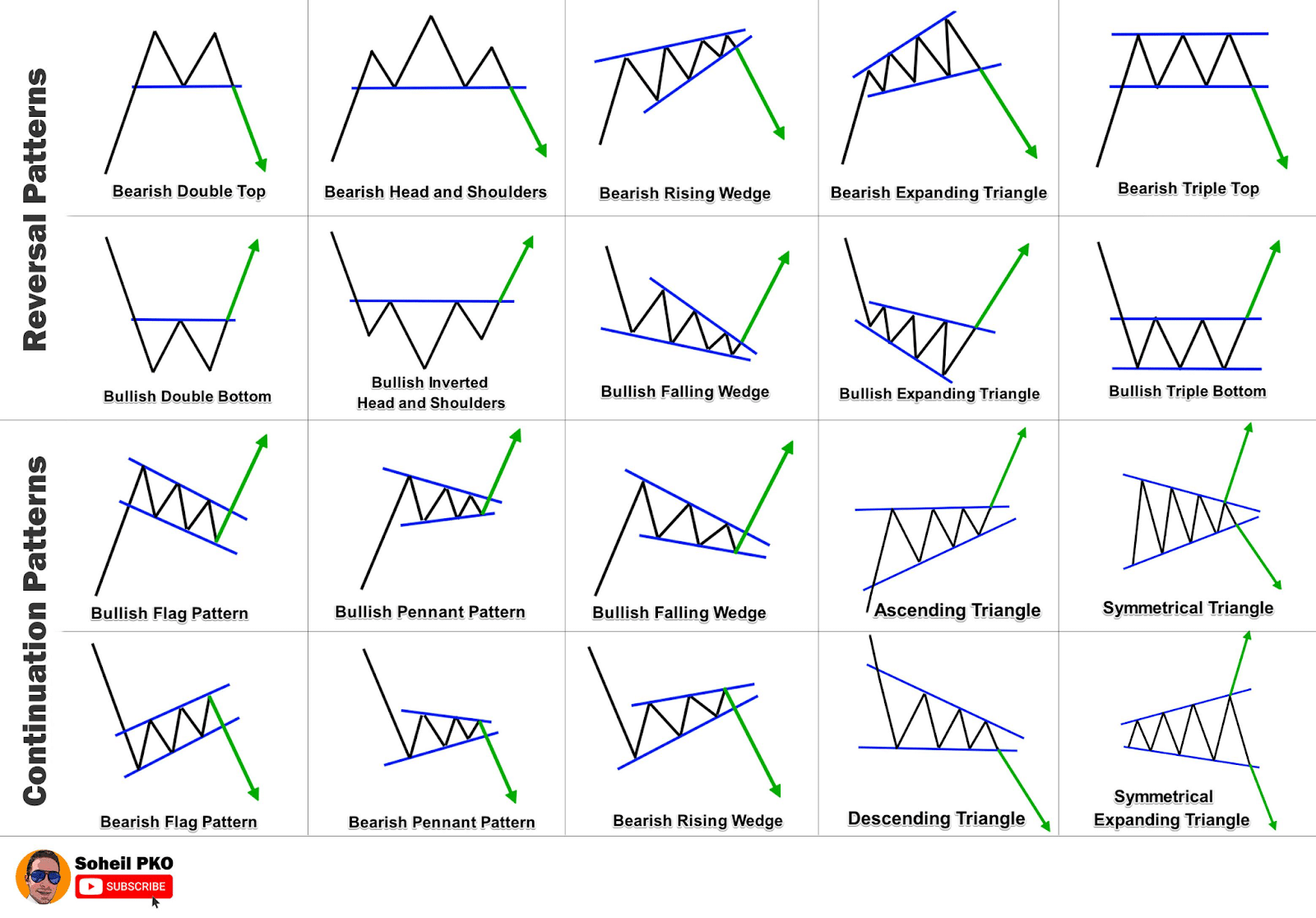

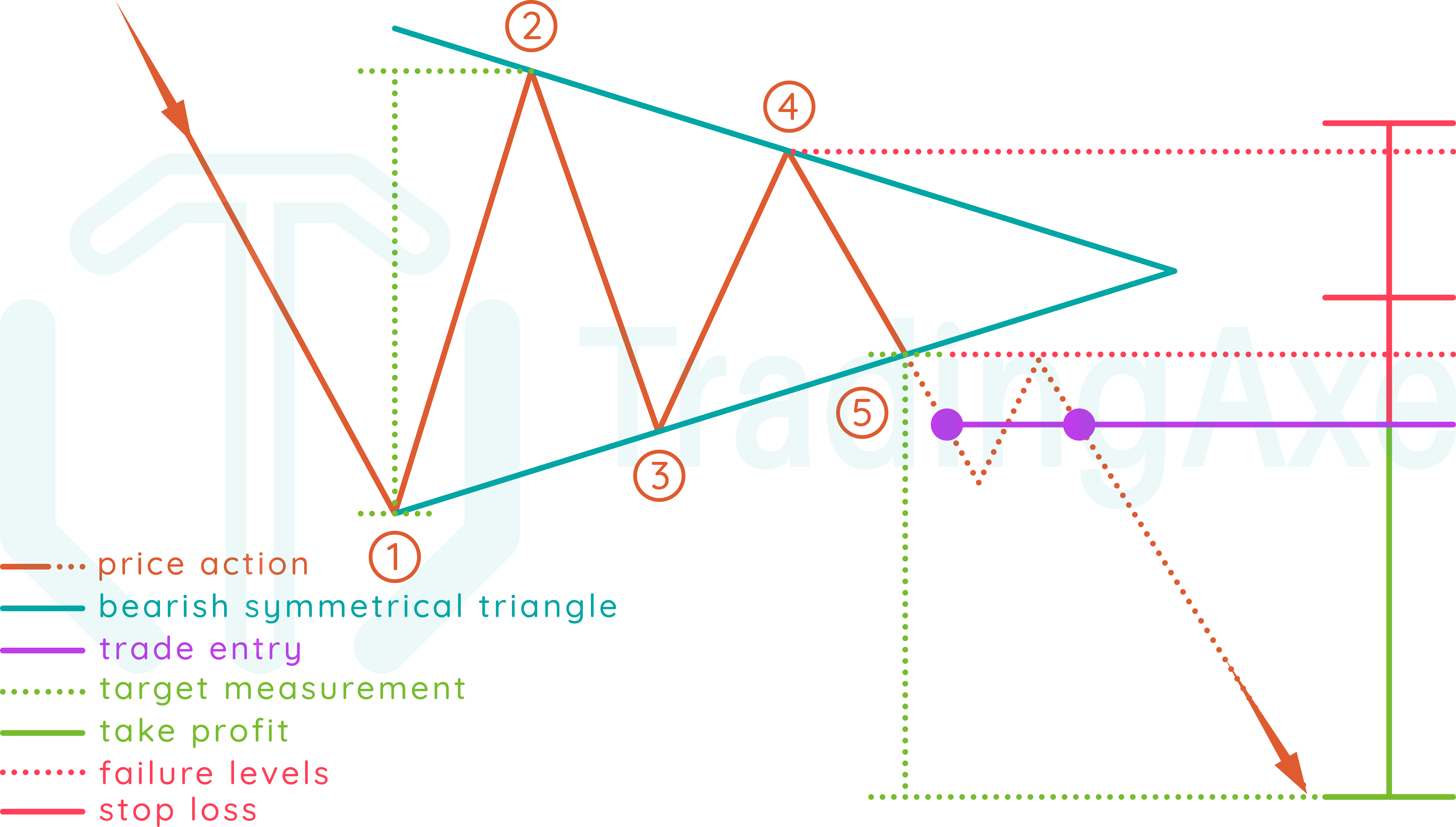

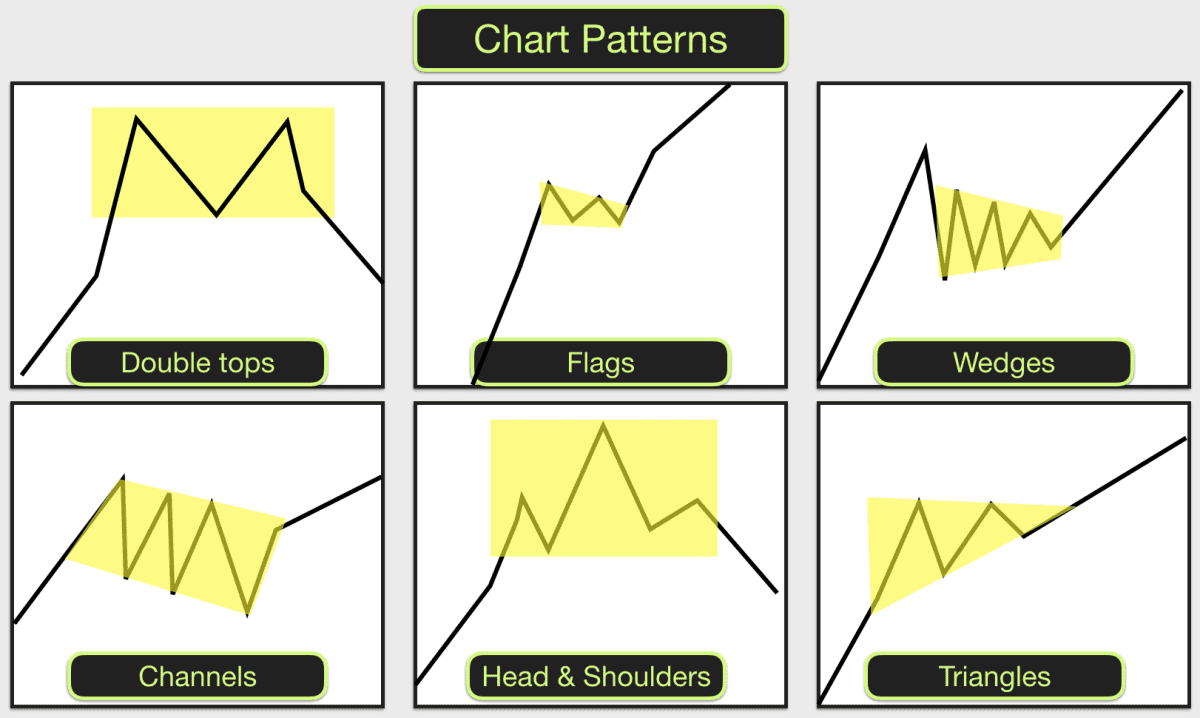

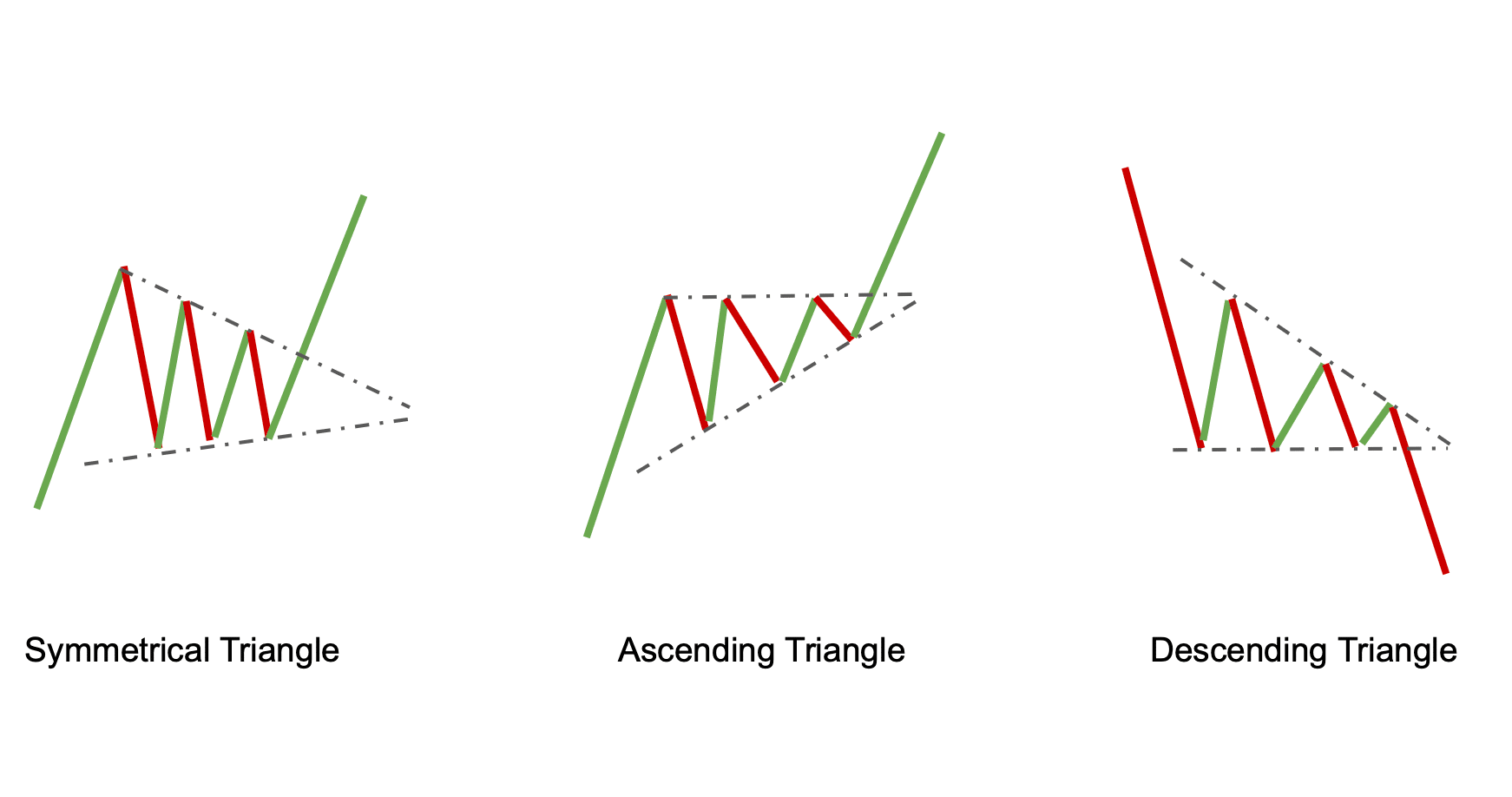

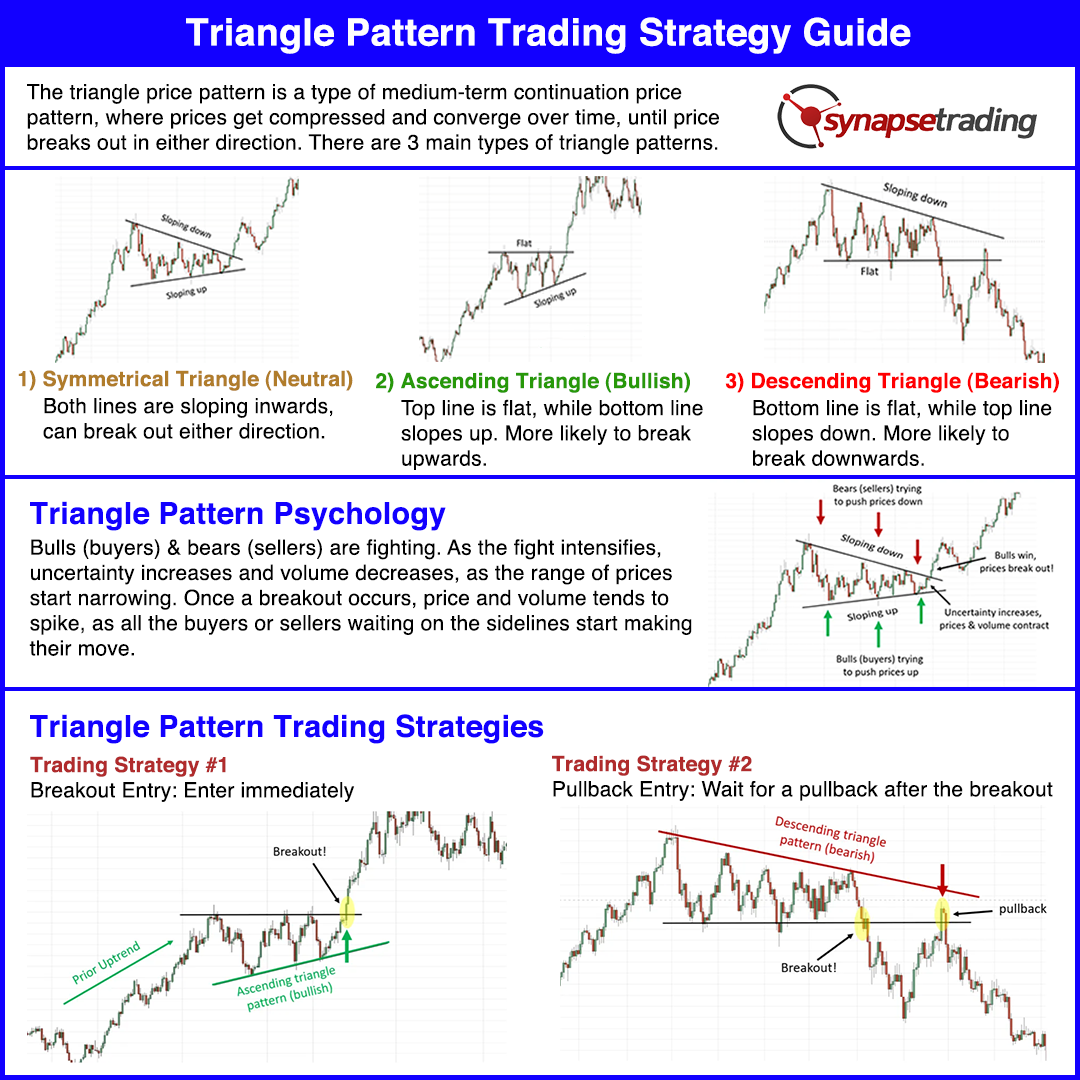

What are chart patterns? Time series data are sequences of values that are obtained by sampling a signal at a fixed frequency, and time series classification algorithms distinguish time. In this post, we will teach you a strategic process for analyzing chart patterns and filtering only those quality setups with optimal risk/reward.

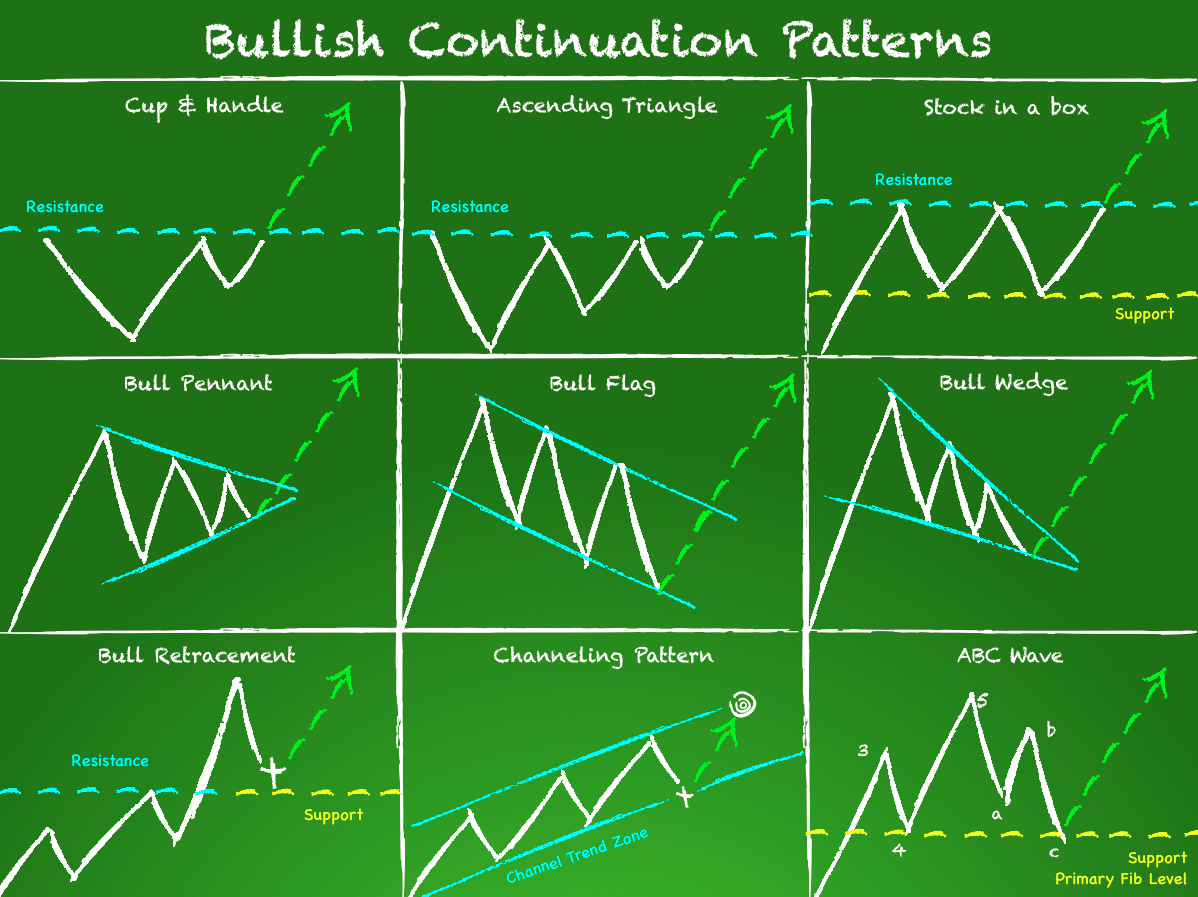

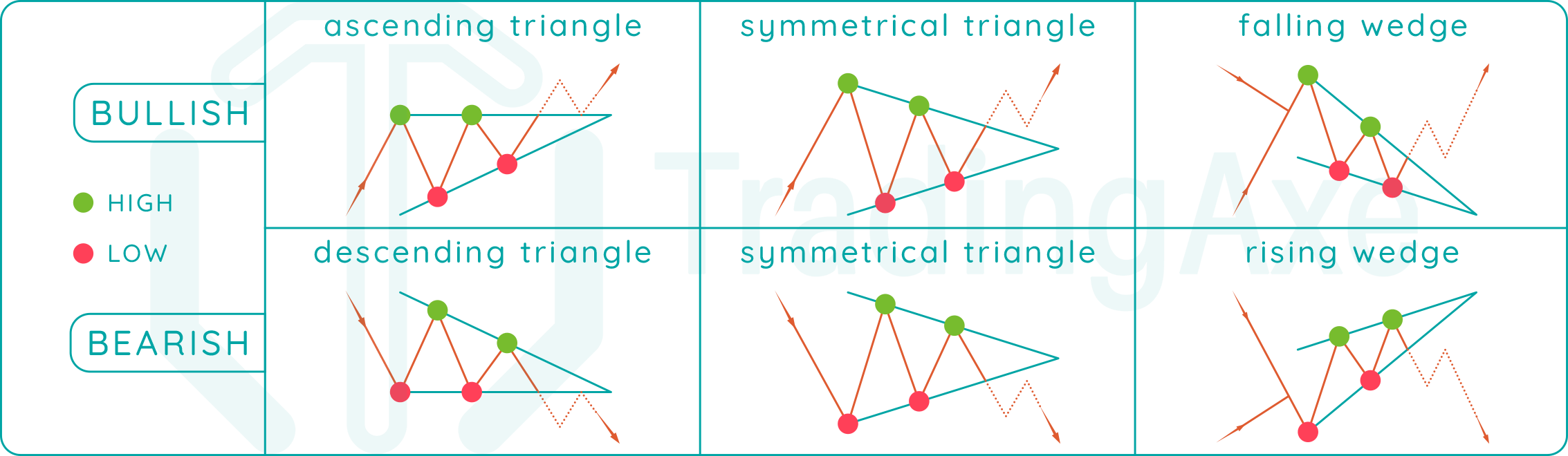

The predictive power of these patterns not only deepens. Keen on acing forex? Chart patterns refer to recognizable formations that emerge from security price data over time.

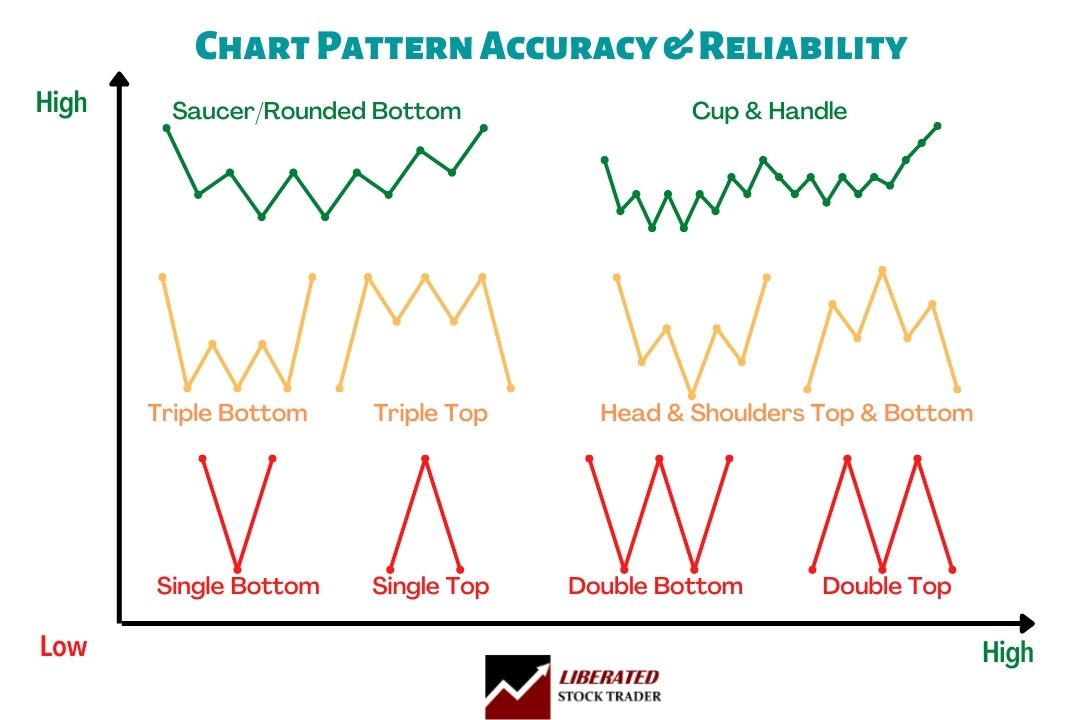

A head and shoulders pattern has three peaks. A bearish session, a gap. Stock chart pattern accuracy and reliability are essentially down.

Why is it important to analyze the chart patterns? Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. Candles, candlestick patterns, support and resistance levels, pivot point analysis, elliott wave theory, and chart.

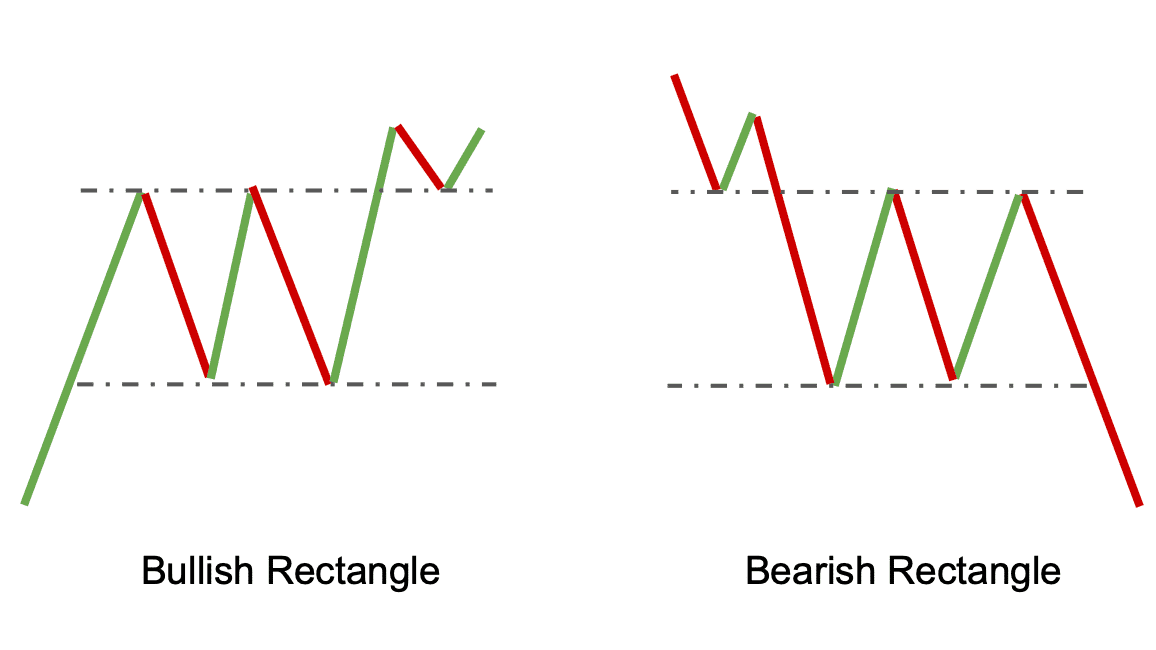

Higher highs and higher lows. The rising highs show that the buyers are able to push price higher. The head and shoulders is considered a.

The first and last are similar in height, while the second peak is taller. A trend can only exist if the highs and the lows rise. This table shows the chart pattern success rate/probability of a price increase in a bull market and the average price increase after emerging from the pattern.

Yes, stock chart patterns work, but not as often as you think. Learning the most common candlestick patterns can give you a significant edge. For example, it can help you: